IB Economics Tariffs & Trade Protection

Discover how tariffs actually work, who wins, who loses, and how to calculate their effects. Essential knowledge for IB Economics students!

IB ECONOMICS HLIB ECONOMICSIB ECONOMICS SLIB ECONOMICS THE GLOBAL ECONOMY / INTERNATIONAL TRADE

Lawrence Robert

4/30/20257 min read

Tariffs Explained: Why Countries Throw Shade at Foreign Products

Grab your favourite overpriced coffee that's probably been hit with import tariffs and let's talk about one of the spiciest topics in international trade: TARIFFS. You know, those taxes that make your beloved foreign chocolate bars cost more than they should. Let's break down why countries use them and who wins and loses when this trade barrier is in place.

IB Economics What Is Trade Protection? (The Government's "My Industry First" Policy)

Your country makes smartphones, but they're a bit "rubbish" compared to foreign brands and cost more to produce. Without trade protection, your domestic phone industry might collapse faster than your motivation during exam season.

Trade protection: Is your government's deliberate attempt to shield domestic producers from getting absolutely destroyed by foreign competition. It's like when your mum steps in to stop your older sibling from beating you at Monopoly... except with billion-pound industries.

Internal Assessment (IA) Guide – Free Download

Step-by-step support on topic selection, structure, evaluation, and most common IB Economics IA mistakes.

Understanding key IB Economics Internal Assessment concepts

Applying and explaining them in real-world IB Economics contexts

Building IB Economics IA confidence without drowning in dry theory and explanations.

Download the IA guide now for free and boost your IB Economics grades and confidence:

Why Do Governments Bother Protecting Trade?

Simple: JOBS, VOTES, and NATIONAL PRIDE.

Even if French wines are objectively better than English wines (sorry, not sorry), the UK government doesn't want English vineyards going bust and creating unemployment in rural areas. Plus, politicians quite fancy keeping their jobs, and "I let our entire steel industry collapse" doesn't look great on campaign posters.

Types of Trade Protection for your IB Economics Course: The Government's Toolkit

There are four main ways governments can throw shade at foreign products:

Tariffs - Taxes on imported goods (we'll dive deep into these today)

Quotas - Limits on how much can be imported

Subsidies - Free government money to make domestic products cheaper

Administrative barriers - Excessive paperwork and regulations to make importers cry

Today, we're focusing on the OG of trade protection: TARIFFS.

IB Economics Tariffs: The OG Trade Barrier

What Exactly Is a Tariff in your IB Economics Course?

A tariff is basically just a fancy name for a tax slapped specifically on imported goods. It's like a club entry fee, but only for foreign products trying to enter your country's market. You are a local resident you don't pay to enter the club, you are a foreigner you pay.

How Do Tariffs Work? (Without Getting Too Technical)

Imagine your favourite foreign chocolate bar normally costs £1. Then your government decides to impose a 20% tariff on imported chocolate. Now that same chocolate bar costs £1.20.

Meanwhile, domestic chocolate (which wasn't taxed) still costs £1.10. Suddenly, the price gap shrinks, and domestic chocolate becomes more competitive.

The key effects:

Foreign chocolate becomes more expensive

Consumers buy more domestic chocolate

Domestic producers sell more chocolate products

Foreign producers cry into their (now less profitable) chocolate

Stakeholder Analysis for your IB Economics Course: Who's Winning and Who's Fuming?

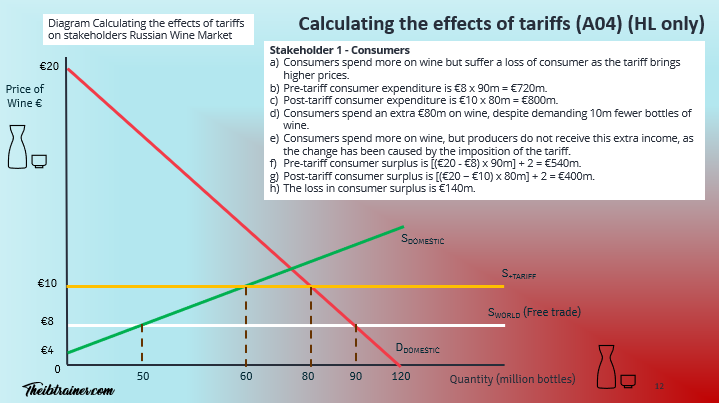

Let's use an IB Economics real-world example with Russian wine imports to understand who wins and loses when tariffs enter the chat. (Don't worry about memorising the numbers - just try to understand the diagrams and the concepts!)

1. Consumers (That's You, Shopping for Wine)

Effect: You're getting absolutely RINSED.

When Russia slaps a tariff on imported wines, all wine prices increase from €8 to €10 per bottle. This means:

You're paying more for the same product

You have fewer imported options to choose from

Your consumer surplus (economic benefit) shrinks dramatically

You buy fewer bottles overall (80 million instead of 90 million)

In our Russian example, consumers end up spending €80 million MORE on wine despite buying 10 million FEWER bottles. That's like paying more for a smaller chocolate bar- utter criminal behaviour, honestly.

Consumer surplus drops from €540 million to €400 million - a loss of €140 million. That's a lot of money that could've been spent on, I don't know, actual fun activities for teenagers instead of overpriced wine.

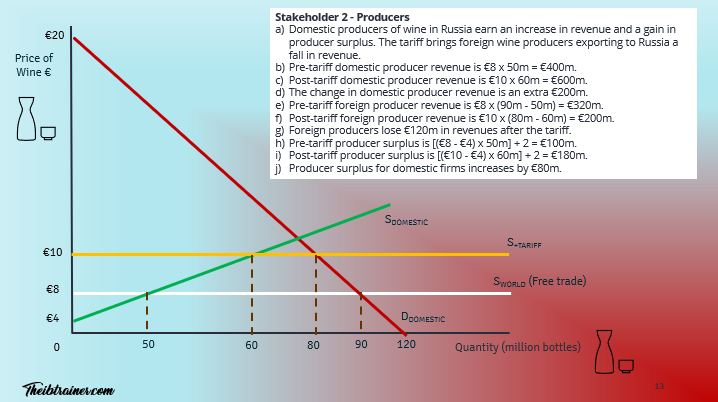

2. Domestic Producers (Russian Winemakers)

Effect: They're absolutely BUZZING.

Russian winemakers are living their best lives after tariffs:

They sell more wine (60 million bottles instead of 50 million)

They charge higher prices (€10 instead of €8)

Their revenue jumps from €400 million to €600 million (a €200 million increase!)

Their producer surplus increases by €80 million

No wonder domestic producers lobby for tariffs - they're making bank while doing exactly the same thing they did before.

3. Foreign Producers (Non-Russian Winemakers)

Effect: They're absolutely FUMING.

Foreign winemakers are the biggest losers:

They sell fewer bottles (20 million instead of 40 million)

Their revenue plummets from €320 million to €200 million

Their comparative advantage gets neutralised

They might have to exit the Russian market entirely

Foreign producers lose €120 million in revenues after the tariff. That's why countries get annoyed when their trading partners impose tariffs, and why they often retaliate (hello, trade wars!).

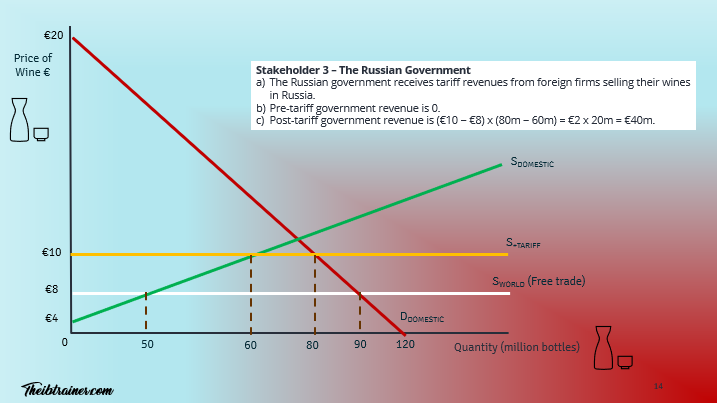

4. The Government (Russian Treasury)

Effect: They're quietly COLLECTING.

The government isn't complaining:

They collect €40 million in tariff revenue (€2 per bottle on 20 million imported bottles)

They protect domestic jobs

They can claim they're "standing up for national industries"

But: the World Trade Organisation might come knocking, and other countries might retaliate with their own tariffs on Russian exports.

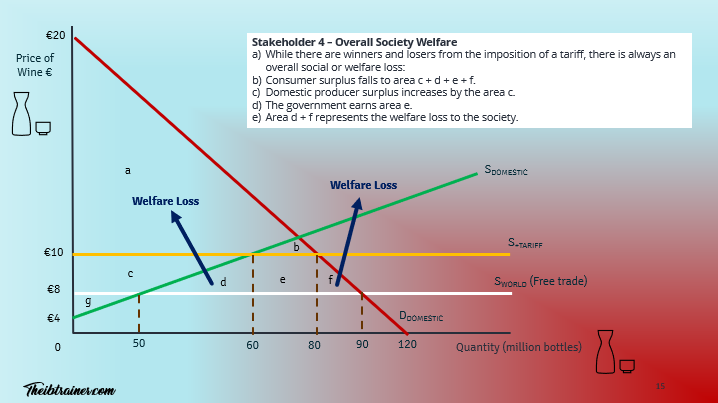

5. Overall Society (Everyone in Russia)

Effect: There's a NET LOSS to society.

Here's something your IB Economics examiners will love: despite some stakeholders winning, society as a whole is worse off.

Consumer surplus falls by €140 million

Producer surplus increases by €80 million

Government collects €40 million

NET WELFARE LOSS: €20 million (€140m - €80m - €40m)

This welfare loss (or deadweight loss if you want to sound extra smart in your exams) represents pure economic inefficiency. It's value that simply disappears into the void!

IB Economics Calculating Tariff Effects: The Numbers Game (HL Students, This Is Your Jam!)

For those of you brave souls taking Higher Level Economics, you need to know how to calculate these effects. Let's walk through it using our Russian wine example:

Consumer Effects

Before Tariff:

Price: €8 per bottle

Quantity: 90 million bottles

Expenditure: €8 × 90m = €720 million

Consumer Surplus: [(€20 - €8) × 90m] ÷ 2 = €540 million

After Tariff:

Price: €10 per bottle

Quantity: 80 million bottles

Expenditure: €10 × 80m = €800 million

Consumer Surplus: [(€20 - €10) × 80m] ÷ 2 = €400 million

Net Effect:

Spending increases by €80 million (€800m - €720m)

Consumer surplus decreases by €140 million (€540m - €400m)

Buying fewer bottles but spending more money (classic tariff effect)

Domestic Producer Effects

Before Tariff:

Price: €8 per bottle

Quantity sold: 50 million bottles

Revenue: €8 × 50m = €400 million

Producer Surplus: [(€8 - €4) × 50m] ÷ 2 = €100 million

After Tariff:

Price: €10 per bottle

Quantity sold: 60 million bottles

Revenue: €10 × 60m = €600 million

Producer Surplus: [(€10 - €4) × 60m] ÷ 2 = €180 million

Net Effect:

Revenue increases by €200 million (€600m - €400m)

Producer surplus increases by €80 million (€180m - €100m)

Selling more bottles at higher prices (dream scenario)

Foreign Producer Effects

Before Tariff:

Quantity sold: 40 million bottles (90m - 50m)

Revenue: €8 × 40m = €320 million

After Tariff:

Quantity sold: 20 million bottles (80m - 60m)

Revenue: €10 × 20m = €200 million

Net Effect:

Revenue decreases by €120 million (€320m - €200m)

Selling half as many bottles (nightmare scenario)

Government Revenue

Before Tariff:

Revenue: €0 (no tariff)

After Tariff:

Tariff per bottle: €2 (€10 - €8)

Bottles imported: 20 million

Revenue: €2 × 20m = €40 million

Overall Welfare Effect

Consumer surplus loss: -€140 million

Producer surplus gain: +€80 million

Government revenue gain: +€40 million

Net welfare effect: -€20 million (deadweight loss)

The Big Picture for your IB Economics Course

Understanding tariffs isn't just about memorising definitions - it's about analysing who wins and loses, and by how much. This is EXACTLY what IB Economics examiners want to see:

Stakeholder analysis - Showing you understand different perspectives

Calculations - Demonstrating you can quantify economic effects

Evaluation - Recognising trade-offs and welfare losses

Real-world application - Connecting theory to actual situations

In your IB Economics exams, you might get asked to:

Explain why a country might use tariffs despite the welfare loss

Calculate the effects of a specific tariff

Evaluate which stakeholders benefit most / least

Discuss alternatives to tariffs

Real-World Tariff Examples for your IB Economics Course

Trump's Steel and Aluminium Tariffs (2018): President Trump imposed 25% tariffs on steel imports and 10% on aluminium. American steel producers celebrated while car manufacturers (who use steel) complained about higher costs. The EU retaliated with tariffs on American products like bourbon whiskey and motorcycles.

Brexit Tariff Uncertainty: After Brexit, many UK businesses faced potential tariffs when trading with the EU. This uncertainty led some companies to relocate operations to EU countries to avoid these barriers.

China-Australia Wine Dispute (2020-21): China imposed tariffs up to 212% on Australian wine after political tensions. Australian wine exports to China collapsed by 97%, devastating Australian producers who had relied on the Chinese market.

Trump's 2025 tariffs: In early 2025, President Donald Trump reignited trade tensions by announcing significant tariffs:

25% tariffs on all imports from Canada and Mexico, citing concerns over illegal immigration and drug trafficking.

10% tariffs on imports from China, aiming to pressure Beijing on various issues.

For access to all IB Economics exam practice questions, model answers, IB Economics complete diagrams together with full explanations, and detailed assessment criteria, explore the Complete IB Economics Course:

Exam-Ready IB Economics Evaluation Points

To absolutely nail your IB Economics papers, remember these evaluation points about tariffs:

Short-term vs. Long-term effects: Tariffs might protect jobs in the short term but reduce industry competitiveness long-term by removing incentives to innovate.

Size matters: Small tariffs might raise revenue without significantly distorting trade, while large tariffs can destroy trade relationships.

Strategic industries: Some argue certain industries (defence, food production) deserve protection for national security reasons.

Retaliatory risk: Imposing tariffs often triggers retaliation, potentially hurting export industries more than helping protected ones.

Development stage: Developing countries might use tariffs to protect infant industries until they can compete globally (though this rarely works in practice).

Every episode of Pint-Sized links back to what matters most for your IB Economics course:

Understanding key IB Economics concepts

Applying them in real-world IB Economics contexts

Building IB Economics course confidence without drowning in dry theory.

Subscribe for free to exclusive episodes designed to boost your IB Economics grades and confidence:

Next up: We'll explore quotas (the "you can only bring THIS much" trade barrier) and subsidies (the "here's some free money to compete" approach).

IB Economics Diagrams Programme, What's included:

200+ exam-ready diagrams covering the entire IB Economics syllabus

Video for every diagram showing you exactly how each model looks

Image version perfect for modelling diagrams in you essays, presentations, and your IA

Detailed written explanations of the IB Economics theory behind each diagram

Both SL and HL IB Economics diagrams clearly labelled and organised by topic

Real IB Economics exam application showing how to use diagrams effectively in Paper 1 and Paper 2

Stay well,

© Theibtrainer.com 2012-2026. All rights reserved.

More Basic Resources For IB Students:

Legal

Have a Tip? Send us a tip using our anonymous form